Brand modernization experience from banking practice

The role of brand modernization is difficult to overestimate. A brand is not just a business name of a company, a trademark, not just a flag or a symbol. In fact, this is a complex concept, in the most general form it is a business value system, that is, what the company sells to customers. Obviously, a strong brand that has many supporters has an independent value, allowing you to keep a higher price bar for goods and services. A strong brand also allows you to save on promotion, thanks to better recognition in the market.

The author first encountered the problem of brand modernization in childhood. The old pirate John Silver from Robert-Llues Stevenson’s novel “Treasure Island” was an ardent opponent of renaming ships, against rebranding. Here are his words: “… They died because they changed the names of their ships. Today the ship is called “Royal Happiness”, and tomorrow something else. And in our opinion – as the ship was christened, so it should always be called.”

The business clearly comes to the conclusion that the brand must be managed, developed and modernized in accordance with the changing environment. Brand modernization can follow an evolutionary path, implying a gradual change of the brand, or a revolutionary path, when the brand changes dramatically, up to the destruction of the old and the creation of a completely new brand.

Ways to modernize the banking brand

1. Restyling is an evolutionary method of modernization. Involves a gradual change in the brand.

2. Rebranding is a revolutionary method of modernization. It involves a rapid change in the brand. The key point is the change of name, the dismantling of the old brand. Along with the fact that a powerful information occasion appears and the novelty effect develops, there are risks of getting negative from existing customers.

3. Mixed type – a combination of restyling and rebranding. In some cases, a gradual restyling in terms of the strength of brand modernization can be compared with a rebranding.

I Restyling. When is it applicable?

Restyling is a change of identifying elements, which primarily implies the preservation of the name of the bank.

When restyling is applied

1. Create a novelty effect. As a rule, corporate colors and fonts change, additional elements appear, for example, an underlining line. The main rule is that the brand must remain recognizable, continuity with the old brand image must be maintained.

An example is the restyling of Renaissance Credit Bank in 2019. As a result of the brand update, the Bank retained the name, but changed the logo, in particular, the fonts were changed and the green colors were removed.

2. New development strategy (e.g. entry into the retail market).

2008 – 2019, since 2019

A classic example is the modernization of the brand of Promsvyazbank, which has turned from a bank with a strong retail component into a universal bank.

3. Restyling in the process of mergers and acquisitions (M&A) – while maintaining a strong brand.

2011 – 2022, since 2022

In 2011, Rosbank received the logo of the parent structure societe Generale Group, which bought it, but the brand name remained the same. The name of the brand remained after the change of shareholder in 2022.

4. Restyling with the allocation of a sub-brand – for example, the allocation of a retail sub-brand.

Example of the separation of the retail sub-brand Deutsche Bank 24

The Deutsche Bank 24 sub-brand was launched in 2005. Three years after the start of the implementation of the rebranding program of Deutsche Bank 24, after millions of investments in its development and huge expenditures on its implementation, the retail brand had to be selected under a single “umbrella”. The new brand was counterproductive.

Example of the allocation of the retail sub-brand Alfa-Bank Express

Another example of the separation of a retail sub-brand is the emergence of a modernized retail brand Alfa Bank Express in 2003. But a few years later, this model was recognized as ineffective and already in 2006 the Alfa Bank Express brand served as the basis for a deep restyling of Alfa-Bank – the main brand received its corporate red color and logo in the form of the letter A.

2006 – 2019, since 2019

II Rebranding. When is it applicable in the bank?

Rebranding is a complex event that includes both repositioning and deep restyling. On the one hand, the attitude to the brand of the outside world should be changed, on the other — the brand should change from the inside. The key condition is that as part of the rebranding, the company also changes its name.

When rebranding is useful

1. Rebranding in the course of mergers and acquisitions (M&A).

International Moscow Bank – one of the oldest banking brands, was founded in 1989, in 1991 it received a license from the Central Bank No. 1. In 2005, the bank received a new shareholder – UniCredit Group and in 2008 was renamed. On the one hand, a brand with a 19-year history was destroyed, but on the other hand, the bank received a clear positioning of a foreign banking structure (previously it was not always clear to customers).

2. The new strategy is very different from the old positioning

In 1993, the Republican Investment and Credit Bank Bashkreditbank appeared in the Republic of Bashkortostan. Over time, the bank became the largest bank in the region, in 1997 it overtook Sberbank in terms of the number of legal entities serviced. The Bank has developed a powerful network of branches throughout the country, the business has grown to the federal level and the regional brand has become an obstacle to development nationwide. As a result, in 2002, the bank of the RCB “Bashkreditbank” received a new name – “Ural-Siberian Bank”. It should be noted that during the rebranding, the bank retained its logo to ensure continuity, and this brand remains today, having successfully survived a series of mergers and acquisitions in 2005 and reorganization procedures.

3. Image irretrievably damaged

In 2010, the Russian BTA Bank received a new name – AMT-Bank. The bank is forced to abandon the former brand in order to distance itself from the scandalous events related to the nationalization of the Kazakh BTA Bank. But on July 21, 2011, the license of AMT Bank was revoked.

III Mixed type – a combination of restyling and rebranding

A classic example of mixed brand modernization is the development of sberbank’s brand.

2009 – 2020, since 2020

During the period 1991 – 1994, the Sberbank brand underwent minor changes, but already in 2009 it was significantly modernized, receiving a more modern logo and brand name. In 2020, the Sberbank brand experienced a cardinal restyling, which was due to the fact that Sberbank became actually an umbrella brand of an extensive ecosystem that includes a wide range of businesses. The abbreviation of the name reflects the generally accepted brand name in the market. Vneshtorgbank went a similar way, in 2006 turning into VTB, and the new brand name retained its recognition.

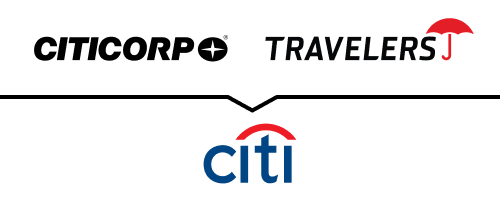

International M&A rebranding experience

So, the modernization of the banking brand can go in different ways. It is important to clearly understand that this process has the primary goal of increasing brand awareness, which should lead to increased sales. The author is a supporter of the gradual restyling of the banking brand, implying the preservation of the continuity of the brand image. Only in this case the brand will be familiar to existing customers and will arouse the interest of new users of products and services.

Vassili Kutin, Ph.D.

Bank marketing expert

Sources

- Central Bank of Russia

- Websites of banks

- https://theroxor.com

- https://www.kommersant.ru/doc/721050

- https://banks-finance.ru/

- bo.bdc.ru/2006/11/nikola_stanish.htm

- https://adn.agency/blog/article/rebrending_po_russki_kakie_kompanii_obnovilis_v_2019

- https://www.business-gazeta.ru/news/20339?real_city=Kazan

- https://www.unicreditbank.ru/ru/about/overview/history.html