Plastic card can be confidently called one of the great inventions of civilization. This is a reusable financial instrument that can simultaneously carry out accumulative, settlement and credit functions, relevant acting as a convenient substitute for cash. A bank card is also a financial passport of the client, it contains personal data about the cardholder, which allows you to almost instantly establish the fact of the presence of the client in the databases and check the availability of funds on the card account.

Features of the card as a financial product

The bank card has a package

Financial and credit products are overwhelmingly services, they are produced at the time of consumption, and as a result cannot have material packaging tangible for the consumer (except of a paper contract, which is very often concluded electronically). As you know, the packaging also has bars and coins from precious metals sold by banks, savings certificates. But only the card, thanks to the design, received a package that allows you to distinguish one product from another, therefore, the card has a material feature of the goods. The card also acts as a visual carrier of brands: bank, payment system, partners, loyalty programs.

Bank card – the most common banking product in Russia

At the beginning of 2022, according to the Central Bank of the Russian Federation, 334.7 million cards were issued, thus, there are more than 2.3 cards per 1 inhabitant of our country.

The card is able to accompany the client all his life, from childhood (children’s cards in Russia are available to customers aged 6 years) to old age (pension cards).

The card often works as a carrier of cross-selling

— combining several products and services of the bank at once. For example, the card can act as an “entrance ticket” when promoting consumer loans, deposits, remote banking services and other products.

The card is also a visible tool for cooperation between banks and partners. Obviously, without cards, affiliate programs would not have received such a spread in the retail business. Today, co-branded and multi-branded cards go beyond the bank, extending the useful properties of the identification payment and credit tool to supermarkets, insurance companies, car dealerships, airlines and a wide range of other partners.

The card can act as a reflection of the values that the client shares

Here you can distinguish various charitable programs tied to cards (for example, environmental cards), religious cards (for example, cards based on Sharia, which are issued by Islamic banks). In this series and cards of communities of interest – club cards of sports fans, fans of certain network games and other social groups. Separately, gender cards can be distinguished, issued and positioned specifically for men and women.

In terms of functional content, the bank card acts as a convenient and technological alternative to a whole range of financial and credit products

- Cash – debit and prepaid cards.

- Key-carrier of remote banking services: 1) cash withdrawal in ATMs, cash points and cash desks of financial and credit institutions and 2) the function of non-cash payment of trade and service enterprises, as well as in the Internet space.

- Demand deposits – debit cards.

- Term deposits – debit cards that offer an increased interest on the balance.

- A product combining a demand deposit, a settlement instrument and a loan – overdraft cards

- Consumer loan – credit card and overdraft card.

The bank card as a product is also unique for its innovative nature, which has completely changed the world. The place of the card in the evolution of money and calculations can hardly be overestimated. If we consider the key points of development of money and settlements, we can see that with the advent of cards, the pace of development of payment and settlement systems and structures received a powerful impetus, as a result of which they accelerated tenfold.

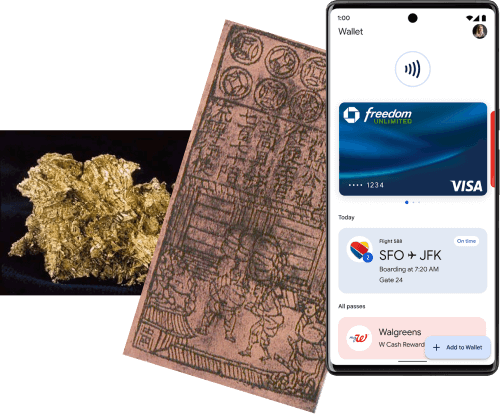

The place of the card in the evolution of money and settlements

| Precious metals: gold and silver | Gold and silver gradually supplanted other commodities in the exchange of goods. |

| First Metal Money | Coin – Lydia (Asia Minor) – about 685 BC. |

| First Paper Money | Paper money — China – private VIII century A.D., public — 812 A.D. |

| First Credit Cards | The first universal credit card (Diners Club) appeared in the USA in 1950. |

| First mobile payments | The first mobile payment was made in 1997 by residents of Helsinki, when two Coca-Cola vending machines for the sale of drinks via SMS were installed on the streets of the city. |

| First virtual cards | In 2011, Google Corporation presented the “cloud” wallet Google Wallet, in which it was possible to create virtual cards online. |

From the table it is clearly seen that in the segment from the appearance of the first coins to the appearance of the first paper money, about one and a half thousand years passed, and about 1100 years passed from the first banknotes to the first cards. Only 47 years have passed since the appearance of the first credit cards to the first mobile payments, then mobile payment and settlement devices have significantly reduced the use of cards on physical media. 14 years later, in 2011, thanks to Google, cards became virtual, they turned into an electronic application of smartphones. As practice has shown, digitalization did not destroy the card, but simply made it more technologically advanced.

Cards have become a reliable and convenient tool-a human companion, providing not only the functions inherent in cash, but also allowing you to connect credit funds, automate regular payments. This ensured the formation of the most widespread banking product of civilization.